german tax calculator munich

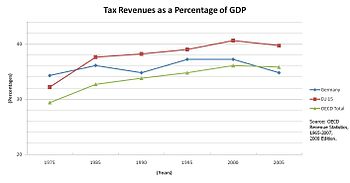

As a general rule of thumb expats should start filing taxes in Germany when they are earning more than the tax-free threshold or minimum income threshold which is currently 9744 per. Setting up a Financial Company in Germany.

Your Bullsh T Free Guide To Taxes In Germany

Tax Calculator in Germany Updated on Tuesday 07th November 2017 Try our instant tax calculator to see how much you have to pay as corporate tax dividend tax and Value Added Tax in Germany as well as detect the existence of any double taxation treaties signed with your country of residence.

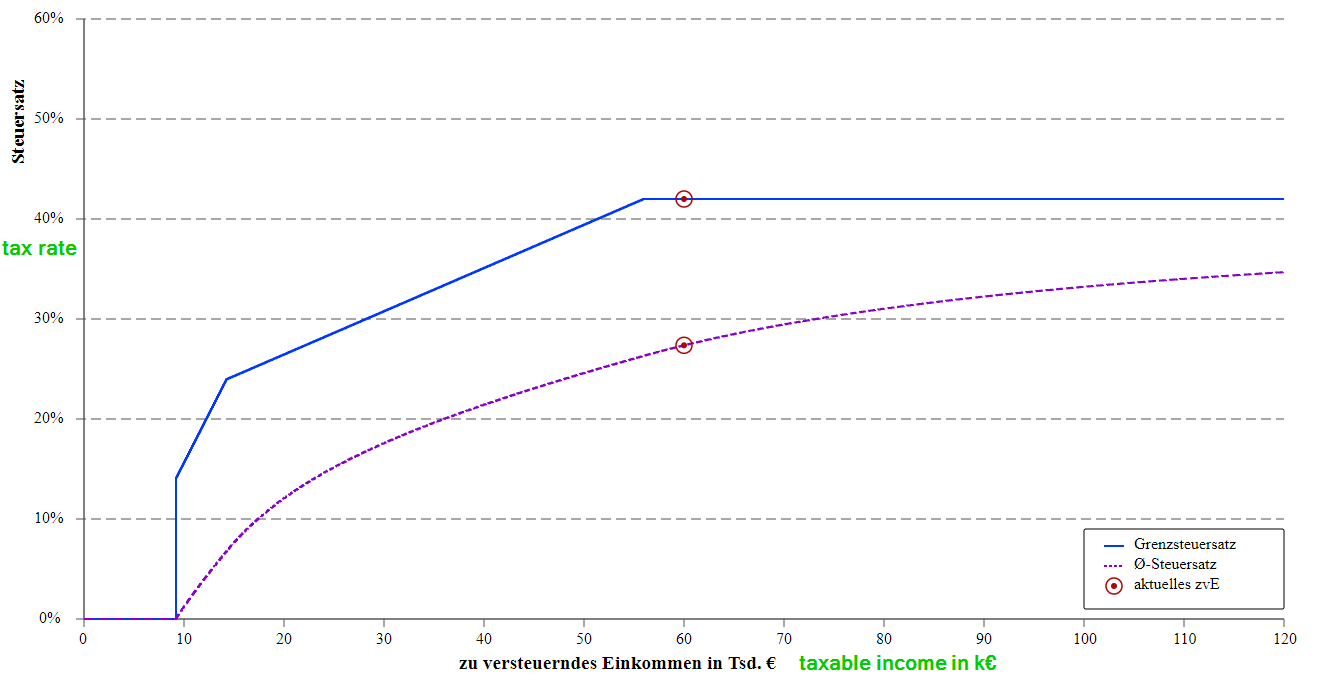

. Use our tax calculator and discover the taxes your company in Germany must pay. For a quick estimation of whether you should consider a tax class change to 3 and 5 you can use this German tax class calculator. It is in German but pretty self-explanatory.

Tax is levied by the municipality in which real estate is located. However how much a company pays also. How much money will be left after paying taxes and social contributions which are.

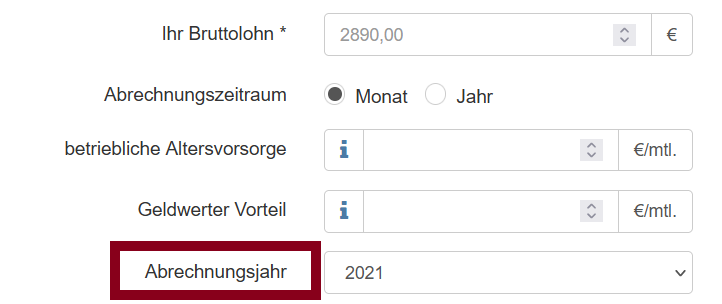

Try our free and easy-to-use tax calculator to see how much you have to pay as corporate tax. Our gross net wage calculator helps to calculate the net wage based on the Wage Tax System of Germany. German Wage Tax Calculator This program is a German Wage Tax Calculator for singles as well as married couples for the years 2010 until 2022.

With our Taxi Calculator for Munich you will get a price estimation based on the official rates published by the city of Munich. That means a full-time minimum wage earner should. The calculator is provided for your free use on our.

German Wage Tax Calculator 2010-2022 For the Year Gross net and net gross calculation with parent allowance Wage Taxes Tax Class and Insurance Tax Class with Pension. Opening a Business in Munich. According to our salary calculator for Germany thats a net salary of around 18405 or 1534 a month if we run the numbers in Berlin.

The more advanced the studies the higher the wage. Singles can earn 8130 EUR. As a working student you can earn a variable hourly wage between the minimum wage currently 935 Euro February 2020 and 20 Euro.

The German Income Tax Calculator is designed to allow you to calculate your income tax and salary deductions for the 2022 tax year. You will find an estimation of your taxi costs in Munich on the. From a higher income onwards small deductions are made.

Those who earn up to 450 euros a month retain the entire income. The general rate is 035 of the tax value of the property multiplied by a municipal coefficient. German tax calculator munich Thursday October 13 2022 Try our instant tax calculator to see how much you have to pay as corporate tax dividend tax and Value Added.

1 Speaker Name Andre Marius Le Prince Company Wlp Gmbh Hamburg Germany Wira Ag Munich Stuttgart Dusseldorf Nurnberg Hamburg Germany Phone Ppt Download

Taxes In Germany The Most Relevant Topics About Taxes To Consider When Moving To Germany

Capital Gains Tax Kapitalertragsteuer German Tax Consultants

Sharing The Burden Empirical Evidence On Corporate Tax Incidence Dwenger 2019 German Economic Review Wiley Online Library

Social Security Taxes Expatrio Com

Salary Calculator Germany Salary After Tax

German Tax System Expatrio Com

Faq German Tax System Steuerkanzlei Pfleger

Ultimate Guide To German Tax Class And How To Change It Johnny Africa

Taxes In Germany The Basics For Self Employed

Best Tax Software To File Your German Taxes In English Steuergo How To File Your Taxes In Germany Youtube

1 Speaker Name Andre Marius Le Prince Company Wlp Gmbh Hamburg Germany Wira Ag Munich Stuttgart Dusseldorf Nurnberg Hamburg Germany Phone Ppt Download

German Income Tax Calculator All About Berlin

Tax Refund Munich Tax Return English Speaking Tax Accountant

Salary Calculator Germany 2022 User Guide Examples Gsf

How To Figure Out The Right Salary Level And Negotiate It Hallogermany

Ultimate Guide To German Tax Class And How To Change It Johnny Africa